Table of Contents

Introduction – why the hidden value chain of embodied AI: from actuators to end‑use matters

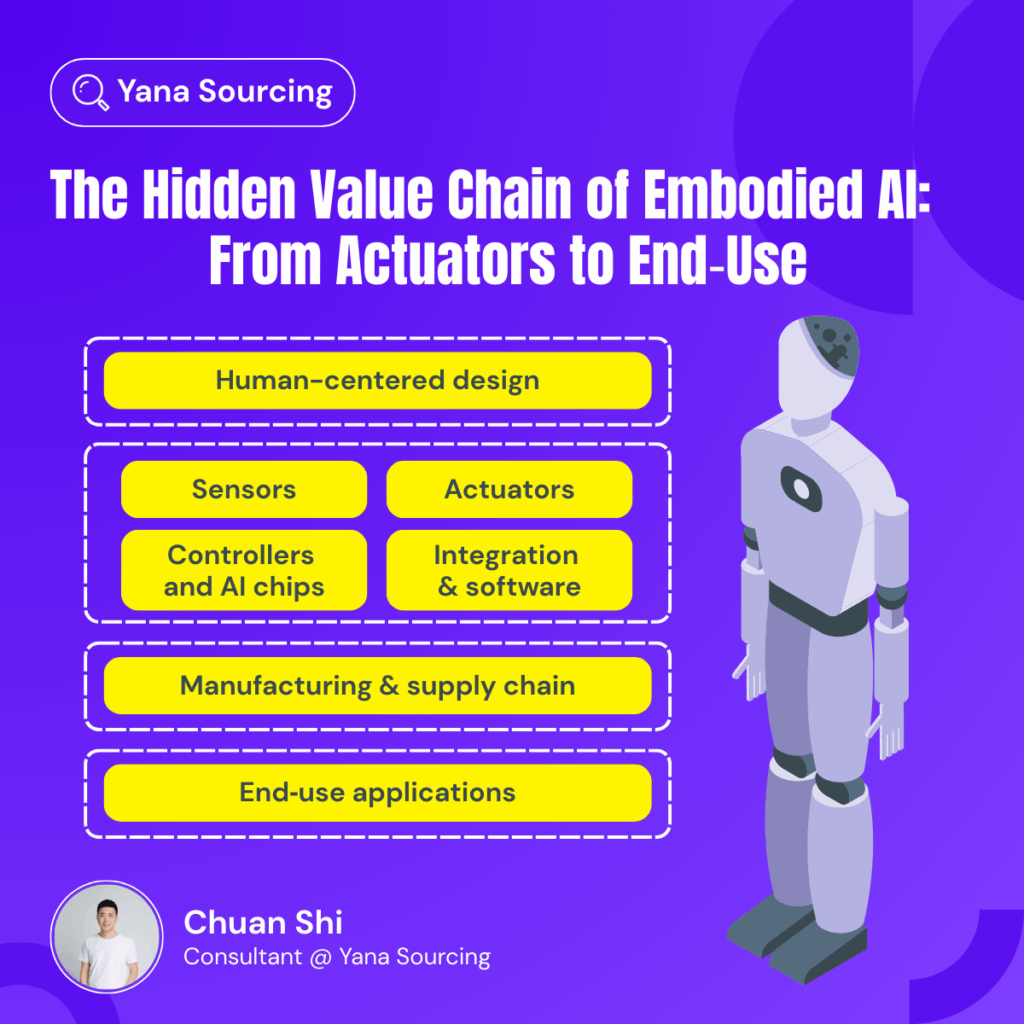

The hidden value chain of embodied AI: from actuators to end‑use is the nervous system that turns code into movement and ideas into hardware. When people imagine intelligent robots they tend to think of glossy humanoids greeting guests or agile quadrupeds running through factories. But the hidden value chain of embodied AI: from actuators to end‑use goes far deeper than the machines on stage: it includes the motors, harmonic reducers, force sensors and semiconductors that give machines their muscles and nerves, the factories in China and elsewhere that make these parts at scale, and the integrators that combine hardware and software into useful products. The International Federation of Robotics (IFR) notes that today’s global market value of industrial robot installations is about US $16.5 billion and is expected to grow as innovations in artificial intelligence and automation expand. This growth will be driven not only by flashy new humanoids but by the maturation of the hidden value chain of embodied AI: from actuators to end‑use: components, supply chains, and end‑use applications.

This article unpacks that hidden value chain of embodied AI: from actuators to end‑use. Each section explores a layer of the chain, from actuators and sensors to AI chips and integration, manufacturing ecosystems, and the real-world applications that generate revenue. The goal of this article is to offer a deep dive for decision‑makers who need to source high‑margin robotics solutions in 2025 and beyond. Using data from IFR and other sources, we will show how China is building an entire ecosystem around the hidden value chain of embodied AI: from actuators to end‑use, why actuators and sensors are the new gold mines, how AI chips and software make physical intelligence possible, how supply chains coalesce around clusters, and where the real profits lie in end‑use categories. We will also highlight the risks, such as the IFR’s warning that general‑purpose humanoids remain uncertain and are likely to complement rather than replace existing robots. By the end of this exploration, readers will have both a macro view of the hidden value chain of embodied AI: from actuators to end‑use and a micro‑level understanding of which links in the chain offer the best opportunities for sourcing and investment.

Actuators – the muscle in the hidden value chain of embodied AI: from actuators to end‑use

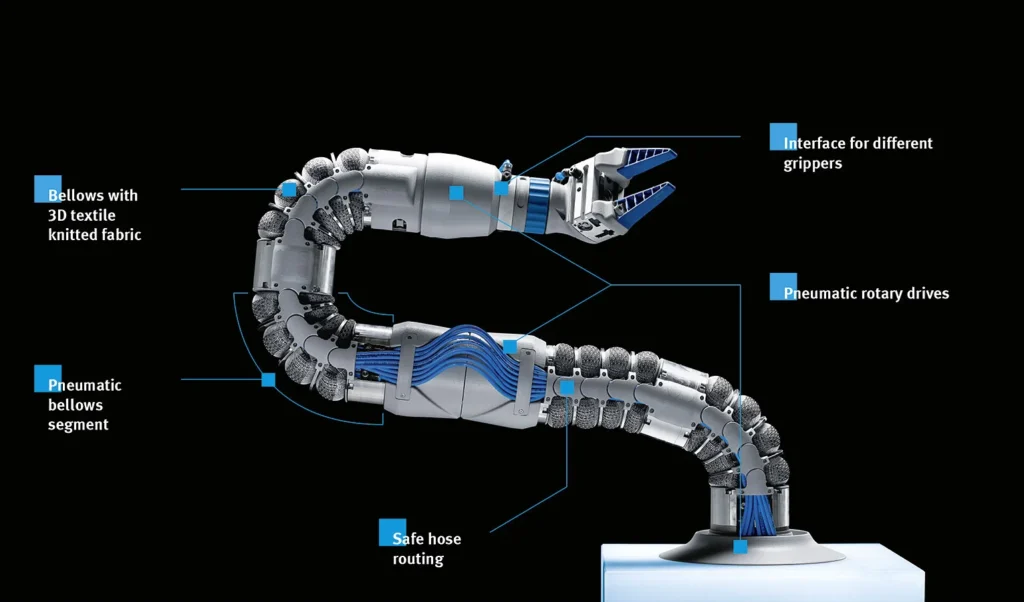

In the hidden value chain of embodied AI: from actuators to end‑use, actuators are the “muscles” that convert electrical, pneumatic or hydraulic energy into mechanical motion. Without actuators, there is no movement; these devices drive the joints of industrial arms, the legs of humanoids and quadrupeds, and the grippers that pick and place objects. Actuators come in many forms, DC motors, stepper motors, servo motors, linear actuators, pneumatic cylinders and hydraulic pistons, and each type serves a particular set of use cases. Actuators such as pneumatic or hydraulic cylinders and electric motors are the power sources that drive the manipulator of an industrial robot. And motors may be coupled directly or indirectly through gears or chains. In high‑performance humanoids, specialized joint actuators (often harmonic drives integrated with brushless motors and torque sensors) account for more than 30 % of the bill‑of‑materials cost, according to industry analyses. That high component cost is precisely why the hidden value chain of embodied AI: from actuators to end‑use offers such attractive margins: advanced actuators remain difficult to design, require precision manufacturing and high‑performance materials, and cannot be easily commoditized. Investors looking for high‑margin categories should pay attention to actuator suppliers.

The hidden value chain of embodied AI: from actuators to end‑use also reveals regional strengths. China has invested heavily in actuator production, with companies such as Harmonic Drive and Nabtesco (the latter headquartered in Japan but with Chinese manufacturing partners) dominating the market for harmonic reducers used in robot joints. Start‑ups and university spin‑offs in Hangzhou and Shenzhen are developing integrated servo‑actuators that combine motors, reducers, sensors and controllers into single modules, dramatically simplifying integration for downstream robot manufacturers. The IFR position paper on humanoid robots notes that China has put humanoids at the center of its national strategy and emphasises establishing a supply chain for key components that is scalable. A scalable actuator supply chain is essential because without high‑volume production the cost curves will not drop to consumer‑friendly levels. Tesla’s CEO famously stated that the humanoid robot business could become larger than the automotive business, but that vision hinges on achieving cost‑effective actuators. Countries that control actuator production control the first critical link in the hidden value chain of embodied AI: from actuators to end‑use.

Sensors – sensing the world in the hidden value chain of embodied AI: from actuators to end‑use

If actuators are the muscles, sensors are the senses in the hidden value chain of embodied AI: from actuators to end‑use. Sensors allow robots to perceive their environment, monitor their own state, and make decisions based on data. The range of sensors used in embodied AI is vast: encoders and potentiometers measure joint angles and velocities; force–torque sensors in grippers and wrists detect contact and enable compliant manipulation; cameras and LiDAR scanners provide vision and depth perception; inertial measurement units (IMUs) and gyroscopes provide balance and orientation; tactile sensors and pressure pads give robots a sense of touch. Feedback devices such as encoders, potentiometers, resolvers and tachometers monitor robot operations and send data to the controller. Without precise sensing, a robot cannot adapt to variation or uncertainty, and embodied AI fails. Thus, sensors form the second critical link in the hidden value chain of embodied AI: from actuators to end‑use.

Sensors are also a significant portion of the cost and complexity of robotics systems. High‑quality force–torque sensors and six‑axis IMUs can cost hundreds or thousands of dollars per unit, and require delicate calibration. Machine vision cameras and LiDAR units incorporate advanced optics and semiconductors, often derived from smartphone and automotive industries. The World Economic Forum notes that humanoid robots rely on a complex multi‑industry supply chain spanning semiconductors, AI systems, actuators and sensors; it highlights that numerous high‑performance chips are required for perception and control, meaning that sensors are both a hardware and a semiconductor story. In the hidden value chain of embodied AI: from actuators to end‑use, sensor suppliers must align with chip makers to ensure compatibility and performance. China has recognized this opportunity: domestic sensor companies are emerging in vision systems, LiDAR for mobile robots, and MEMS gyroscopes. Hangzhou, for example, hosts both actuator and sensor manufacturers alongside AI start‑ups, creating an ecosystem that reduces supply chain risk. For buyers outside China, understanding which suppliers dominate each sensor category is crucial to secure high‑margin deals and avoid bottlenecks.

Controllers and AI chips – the brain of the hidden value chain of embodied AI: from actuators to end‑use

At the heart of the hidden value chain of embodied AI: from actuators to end‑use are controllers and AI chips, these form the “brain” of a robot. The controller interprets sensor data, runs algorithms to plan motion and behavior, and sends commands to actuators. It performs complex calculations while interfacing with end effectors and ancillary devices. The controller is the robot’s brain: it initiates and terminates motion, performs complex computations and interfaces with other devices. In simple robots, the controller may be a programmable logic controller (PLC). In advanced robots, the controller includes CPUs, GPUs and custom AI accelerators running simultaneous localization and mapping (SLAM), visual odometry, language models and reinforcement learning. The IFR notes that robot and chip manufacturers are investing in dedicated hardware and software that simulate real‑world environments so that robots can train themselves; this “Physical AI” aims to create a “ChatGPT moment” for robotics. In other words, advanced controllers and AI chips are turning embodied AI from deterministic automation into adaptive intelligence.

The hidden value chain of embodied AI: from actuators to end‑use depends on semiconductors, without chips there is no brain. Modern robotics uses a mix of general‑purpose computing (CPUs, GPUs), field‑programmable gate arrays (FPGAs), and specialized system‑on‑chips (SoCs) such as NVIDIA’s Jetson series or Huawei’s Ascend. AI chips accelerate neural network inference for vision, language, and control tasks. A single high‑end humanoid may require dozens of chips: a main CPU board running ROS 2, multiple microcontrollers for motor drivers, high‑speed image processing units for cameras and depth sensors, and wireless modules for connectivity. The WEF article explains that the supply chain of humanoid robots involves semiconductors and AI systems along with actuators and sensors, meaning that companies producing AI chips and controllers capture large value. Chinese tech companies like Huawei, Ambarella and Cambrian (Cambricon) are developing AI chips tailored for robotics, giving domestic integrators an edge. This segment of the hidden value chain of embodied AI: from actuators to end‑use offers high margins because specialized chips command premium pricing and because their design and fabrication require deep expertise.

Integration & software – orchestrating the hidden value chain of embodied AI: from actuators to end‑use

Having actuators, sensors and chips is not enough; the hidden value chain of embodied AI: from actuators to end‑use only becomes valuable when these components are integrated with software and orchestrated into complete systems. This integration layer includes mechanical design, electrical harnesses, firmware, middleware, operating systems, and application software. The IFR trends report notes that Analytical AI enables robots to process and analyze large amounts of sensor data to manage variability and unpredictability, while Physical AI uses simulation to train robots in virtual environments. These technologies require sophisticated software frameworks, such as ROS 2, proprietary real‑time operating systems, and reinforcement learning libraries, that can interface with actuators and sensors. In the hidden value chain of embodied AI: from actuators to end‑use, integrators that master software architecture hold significant power: they decide which chips and actuators to use, optimize the control loops, and create modularity for easier maintenance.

Software is also where intellectual property (IP) resides. A major reason high‑margin returns accrue in the hidden value chain of embodied AI: from actuators to end‑use is that control algorithms and AI models can be reused across many applications. For example, a locomotion controller developed for a quadruped can be adapted to a biped with modifications in gait patterns. Similarly, a manipulation policy trained with reinforcement learning in simulation can be deployed to multiple robots thanks to domain randomization. Companies that own these models gain network effects: the more data they collect, the better their models perform, and the greater their market advantage. However, as IFR warns, general‑purpose humanoids remain uncertain and may not become economically viable soon. Therefore, integrators focusing on single‑purpose tasks, such as logistics picking, machine tending, or hospital delivery, can achieve higher margins sooner. The hidden value chain of embodied AI: from actuators to end‑use thus depends on balancing cutting‑edge software with pragmatic application design.

Manufacturing & supply chain – building the hidden value chain of embodied AI: from actuators to end‑use

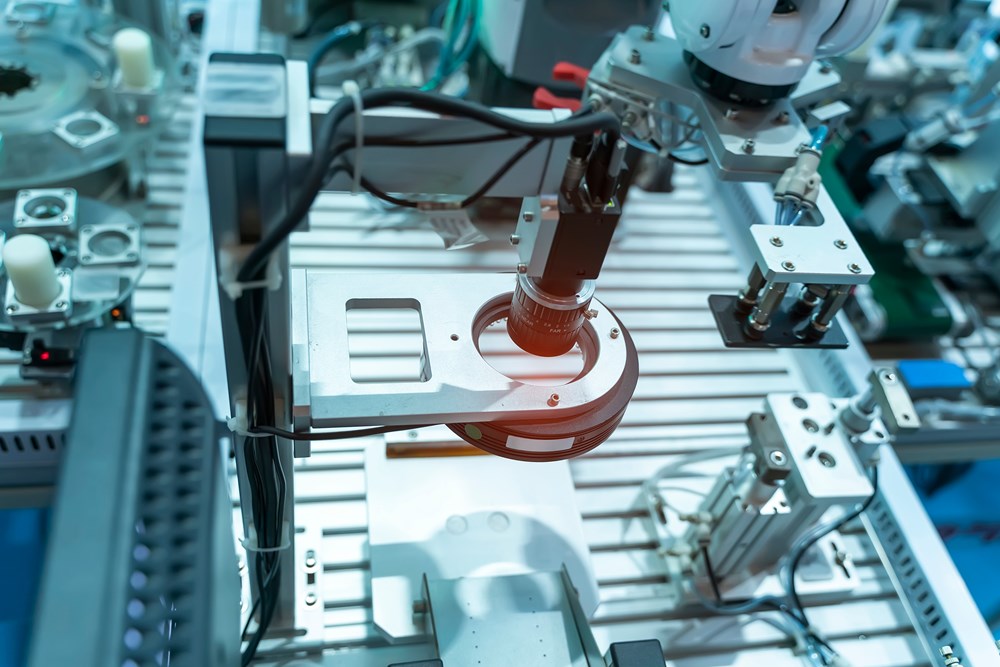

Manufacturing capability and supply chain design determine whether the hidden value chain of embodied AI: from actuators to end‑use can scale. An ecosystem cannot flourish without factories that produce actuators, sensors and chips, as well as assembly plants that integrate them into robots. The IFR’s Humanoid Robots: Vision and Reality update explains that China has made humanoids a national priority and emphasises establishing a scalable supply chain for key components. This includes domestic production of harmonic reducers, servomotors, AI chips, sensors, and high‑precision machining equipment. Regional clusters such as the Yangtze River Delta (Shanghai, Hangzhou, Suzhou), the Greater Bay Area (Shenzhen, Guangzhou, Dongguan) and the Beijing–Tianjin corridor host thousands of robotics component makers and contract manufacturers. The hidden value chain of embodied AI: from actuators to end‑use benefits from these clusters because they create economies of scale, reduce transportation costs and enable rapid iteration. For example, a start‑up in Shenzhen can quickly source prototypes from local suppliers, test them, and iterate in days rather than weeks.

Beyond China, other countries also contribute to the hidden value chain of embodied AI: from actuators to end‑use. Japan leads in precision gearboxes and servo drives; South Korea excels in displays and lithium‑ion batteries; Europe and the United States still dominate high‑end semiconductor design. The IFR trends report notes that robots help manufacturers achieve energy efficiency and sustainability goals by reducing waste and improving output‑input ratios. In green energy technologies, such as solar panels and electric vehicle batteries, robots play a critical role. This synergy means that robotics supply chains also benefit from adjacent industries like automotive, renewable energy and consumer electronics. The hidden value chain of embodied AI: from actuators to end‑use thus spans continents and industries, making supply chain resilience a major concern. Buyers must vet suppliers for quality, lead times, regulatory compliance, and the ability to scale. Yana Sourcing’s private supplier list of vetted robotics suppliers in China can help navigate this complexity.

End‑use applications – monetizing the hidden value chain of embodied AI: from actuators to end‑use

Ultimately the hidden value chain of embodied AI: from actuators to end‑use creates value when robots perform useful tasks. End‑use categories include industrial arms, mobile manipulators, service robots, logistics AGVs (autonomous guided vehicles), medical robots and, increasingly, humanoids. Each category draws on the same underlying supply chain but differs in market maturity and margins. Industrial arms remain the backbone of the robotics industry and have relatively stable margins. Service robots, particularly those used in logistics and hospitality, are expanding rapidly: an IFR press release notes that sales of professional service robots reached 205,000 units in 2023, up 30 % year‑on‑year, and that 80 % of these robots came from Asia. Transportation and logistics robots accounted for 113,000 units, a 35 % increase; hospitality robots sold about 54,000 units, up 31 %, while medical robots grew 36 % and rehabilitation robots jumped 128 %. These numbers show that the hidden value chain of embodied AI: from actuators to end‑use is already producing high‑margin products in practical domains like warehouse automation and health care.

High‑profile humanoids and quadrupeds capture attention but, as IFR warns, may not yet be scalable or economically viable. That does not mean they lack value. Pilot projects in logistics, manufacturing and entertainment generate data and attract investment. The IFR article emphasises that humanoids will likely complement rather than replace existing robots. In the hidden value chain of embodied AI: from actuators to end‑use, humanoids serve two roles: they push the boundaries of integration and control, forcing improvements in actuators and sensors, and they act as a symbol of technological prowess that attracts capital and talent. Meanwhile, service categories like hotel concierge robots and kitchen automation already deliver strong margins because they solve acute labor shortages. IFR notes that robotics helps mitigate global labor shortages and enables workers to focus on higher‑value tasks. This synergy between end‑use benefits and supply chain capability is why the hidden value chain of embodied AI: from actuators to end‑use is so promising.

Challenges and opportunities – managing risk in the hidden value chain of embodied AI: from actuators to end‑use

While the hidden value chain of embodied AI: from actuators to end‑use offers high margins, it also presents significant challenges. One challenge is the economic viability of general‑purpose humanoids. The IFR notes that industrial manufacturers are focusing on humanoids performing single‑purpose tasks because, from today’s perspective, it remains uncertain whether humanoids can represent an economically viable and scalable business case for industrial applications. Companies must therefore strike a balance between investing in cutting‑edge research and targeting realistic use cases. Another challenge is component bottlenecks: high‑torque, low‑backlash joint actuators are expensive and have long lead times, while high‑performance sensors rely on semiconductors that are subject to global chip shortages. Supply chain disruptions, caused by pandemics, geopolitical tensions or export controls, can dramatically slow innovation.

The hidden value chain of embodied AI: from actuators to end‑use also faces regulatory and ethical uncertainties. European regulators emphasise human‑centric design and caution about replacing human workers, while in China and the United States the focus is on productivity and competitiveness. Compliance with safety and quality standards (CE, FCC, ISO 13482 for service robots) adds costs but builds trust. Data privacy and cybersecurity become important when robots collect and transmit sensitive information. On the positive side, the same challenges create opportunities. Low‑cost robotics and Robot‑as‑a‑Service (RaaS) models allow small and medium‑sized enterprises to adopt robots without large upfront investments. Advances in gripper technology, energy‑efficient designs and collaborative safety features make robots accessible to new sectors. Investors who understand these dynamics can identify companies poised to thrive across the hidden value chain of embodied AI: from actuators to end‑use.

Conclusion – unlocking value in the hidden value chain of embodied AI: from actuators to end‑use

The hidden value chain of embodied AI: from actuators to end‑use underpins the robotics revolution. It spans everything from precision actuators and sensors to AI chips, software integration, manufacturing clusters and end‑use applications. As the IFR shows, the global market for industrial robots is growing, yet there is caution about how quickly humanoids will become viable. The World Economic Forum reminds us that embodied AI depends on a multi‑industry supply chain encompassing semiconductors, actuators, sensors and AI systems. To harness this opportunity, sourcing managers and investors must understand each link in the chain: who makes high‑quality actuators and sensors, which AI chips and controllers will dominate, how integration and software create moats, where supply chains are concentrated, and which end‑use categories offer high margins today.

For companies outside China, the hidden value chain of embodied AI: from actuators to end‑use can feel opaque. That is where strategic partners such as Yana Sourcing come in. We maintain a private sourcing list of over 200 vetted robotics suppliers across China, covering actuators, reducers, sensors, AI chips, software integrators and end‑use product manufacturers. Our list includes export track records, certifications, lead times and service capabilities. By leveraging this network, buyers can reduce risk, accelerate development and secure high‑margin opportunities in the hidden value chain of embodied AI: from actuators to end‑use. As 2025 unfolds, the winners in embodied AI will not just be the companies with the most eye‑catching robots; they will be those who master the hidden value chain of embodied AI: from actuators to end‑use and turn it into sustainable competitive advantage.

Leave a Reply