Table of Contents

Executive summary

Consumer drones were a niche curiosity until DJI fused ruthless cost engineering, credible performance, and irresistible storytelling, then shipped at scale. The same pattern is now unfolding in embodied AI, the merger of software intelligence with real-world machines. China is positioning to repeat the DJI playbook in humanoids, legged systems, and industrial arms. The signals are not vague. China accounts for roughly half of new global industrial robot installations and rose to third worldwide in robot density in 2023, a doubling in just four years, backed by a deep supplier base and aggressive policy support.

Three companies personify this shift for global buyers:

- Unitree is smashing price floors for capable humanoids, turning “look what is possible” into “look what is practical.” Its R1 humanoid starts at US$5,900 list, a shock to the system that forces new cost curves for the whole field.

- DEEP Robotics is translating harsh-environment experience in quadrupeds into humanoids and wheel-leg hybrids that matter in industry rather than demos.

- EngineAI came out of nowhere with lifelike bipedal gait videos, a fast product cadence, and early pricing signals that challenge Western cost structures.

The upside is real but not automatic. Beijing’s new World Humanoid Robot Games revealed both impressive progress and the remaining reliability gap. Robots scored goals and ran heats, then tripped, rebooted, and needed human help. That contrast, ambition vs stability, is the exact frontier where buyers, integrators, and sourcing partners can create advantage.

1) Why now

- A compounding base of industrial automation. Asia installed 70 percent of new industrial robots in 2023. China alone took “every other robot,” and it now operates the world’s largest installed base. This is not hype, it is installed steel, the industrial foundation that makes large-scale embodied AI adoption feasible.

- Policy tailwinds. China’s industry ministry issued Guiding Opinions on Humanoid Roebots in late 2023. The goal is not one-off prototypes, it is batch production capabilities by 2025 and standards that align components and safety with scale manufacturing. Municipal action plans in Beijing and Shenzhen layer in funding, pilot zones, and procurement.

- Model breakthroughs meet mechatronics. The embodied AI stack is shifting from vision-language models that “see and say” toward vision-language-action systems that see, decide, act. With compute platforms like Nvidia’s upcoming Jetson Thor focused on humanoids, more of the perception and control is moving on-device, which cuts latency and raises autonomy.

- Cost curves. DJI’s drone moment happened when credible hardware crossed a price threshold that felt almost unfair. Unitree’s R1 at US$5,900 is that moment for entry-level humanoids. The headline may be viral videos, the substance is CapEx math that mid-market buyers can experiment with.

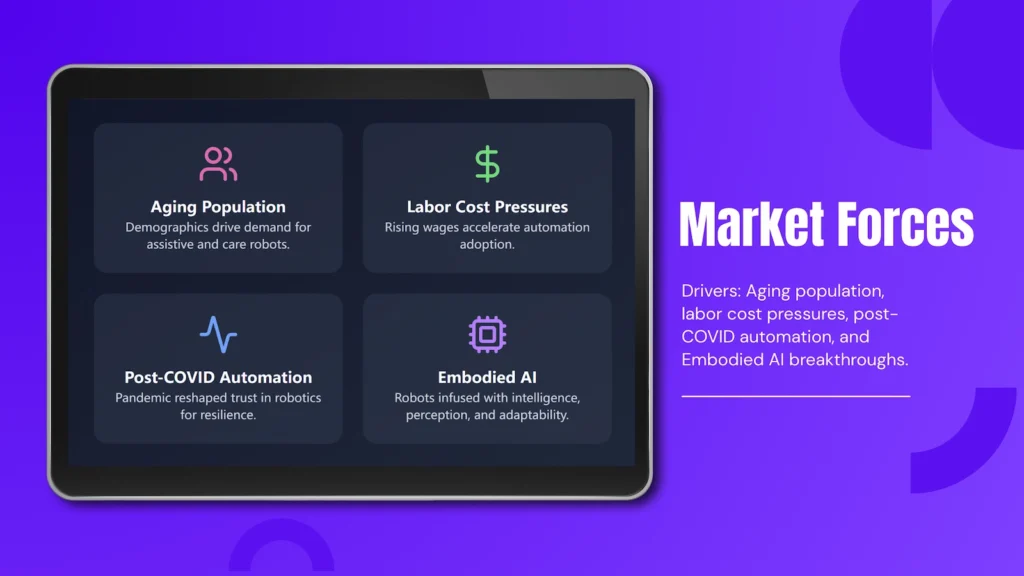

2) Market forces that matter to buyers

- Labor and demographics. China, like many markets, faces an aging workforce and rising expectations for uptime and safety. Automation is not a luxury, it is an operating requirement, and policy is calibrated accordingly. The World Humanoid Games are part testbed, part narrative, and part recruitment for a new industrial base in embodied AI.

- Shifting TAM stories. Forecasts vary by methodology, but the direction is consistent. McKinsey’s base case puts general-purpose robotics in the hundreds of billions by 2040. Morgan Stanley frames humanoids as a multi-trillion opportunity by mid-century, with value chains spanning actuators, drives, AI stacks, and services. What matters for operators is not the exact number, it is that investment in embodied AI is now compounding across the whole stack.

- Asia-first adoption loops. The fastest iteration cycles for service robots, warehouse AMRs, and inspection bots remain in Asia. That learning spills into humanoid workflows, from routine logistics to basic assembly and QC hand-offs.

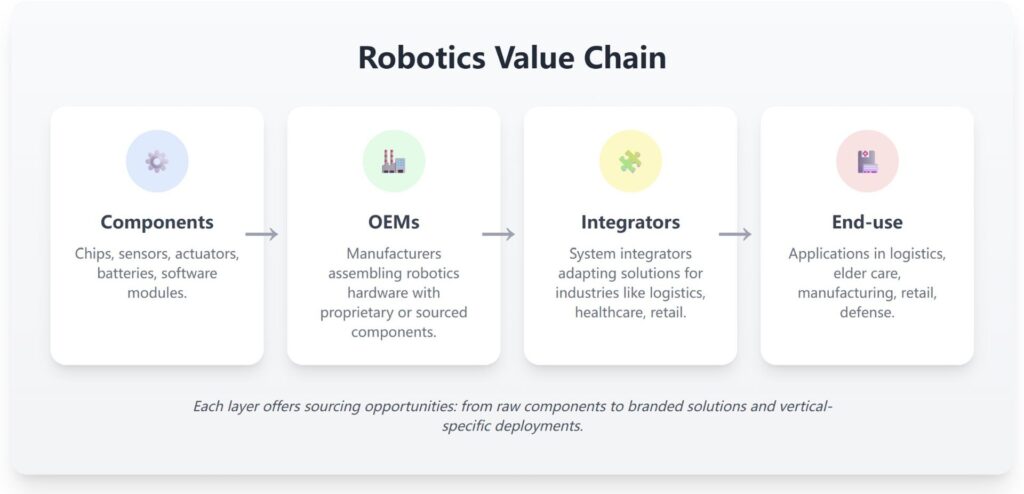

3) Value chain, where margins are created

Components

- Actuators and gearboxes. Harmonic reduction, torque density, and back-drivability define dexterity and safety. China’s domestic suppliers have raised quality and lowered price, narrowing the import gap on reducers, servos, and joint modules. (Policy documents name these as priority breakthroughs.)

- Perception, compute, and power. Depth cameras, event sensors, and multimodal arrays feed foundation models. Onboard compute is shifting toward new SoCs meant for low-latency control loops on humanoids.

Sub-systems

- Hands and end-effectors for industrial arms are moving from rigid grippers to force-controlled multi-finger hands, a prerequisite for real manipulation, not just pick-place.

- Gait and balance controllers. The real battle is software confidence under distribution shift. The Beijing robot games made that visible. The winners were not always the fastest, they were the most robust during failure.

Integrators and OEMs

- Industrial arms from Estun, Efort, Siasun now cover payloads from low single digits to heavy-duty 700 kg systems and are penetrating EV, solar, and materials handling. This matters because every humanoid pilot still relies on proven cells and arms to deliver production value while the humanoid learns.

Services

- Simulation, teleoperation, and data ops will be hidden profit centers. The teams that collect clean datasets of failures and recoveries will compound performance the fastest.

4) Embodied AI leaders by segment, and why they matter now

Humanoids: Unitree, EngineAI

Unitree moved from quadrupeds into humanoids and then accelerated manufacturing capacity. It opened a new Hangzhou factory to support scale, performed at the Spring Festival Gala to national exposure, and is preparing for a domestic IPO. These are not vanity details, they indicate supply readiness and capital access, two things buyers should care about when they plan multiyear rollouts of embodied AI platforms.

- R1, US$5,900 list is a credible anchor for education labs, developers, and pilot tasks like reception hand-offs and guided tours, lowering the entry barrier for embodied AI adoption

- G1 sits higher on capability. Unitree’s public materials emphasize dexterous hands and imitation learning. Buyers should view G1 as a research-to-pilot bridge while R1 seeds a wider developer base in the embodied AI ecosystem.

EngineAI appeared with startlingly natural gait clips and a rapid roadmap: SA01 for research, SE01 full-size for industry, a PM01 smaller variant, plus frequent locomotion improvements. A senior Nvidia scientist amplified the gait video, and local media and analyst notes suggest pricing that undercuts Western peers by large factors. This is the competitive pressure that forces the embodied AI market toward DJI-style price points.

Reality check. Beijing’s World Humanoid Robot Games remind us that field reliability still lags demonstration performance. Any sourcing plan must budget for redundancy, remote assist, and rapid service loops, especially in mixed human environments.

Service robots: Keenon, Pudu, Ecovacs

Why do service robots matter in a humanoid piece? Because they are the revenue engines financing embodied AI. Keenon claims top shipment share in commercial service robots and is rolling role-specific humanoid concepts. Pudu crossed the 100,000-unit mark and is launching heavier-payload delivery lines. Ecovacs shows how large consumer installed bases can underpin components and software reuse across the embodied AI value chain.

Industrial arms: Estun, Efort, Siasun

China’s “workhorse” arms quietly set the baseline for price, lead time, and service coverage. Estun reports a 3–700 kg portfolio and has pushed a 700 kg payload system. Efort and Siasun round out domestic supply with whole-chain integration and overseas ambitions. For many buyers, the first embodied AI value will come from hybrid cells where arms do the heavy lifting and humanoids tackle flexible tasks.

5) Global hotspots, practical sourcing angles

Beijing

World Robot Conference, national labs, and now a global humanoid games stage, Beijing has become one of the most visible hubs for embodied AI development. The city backs robotics with funds and pilot programs that concentrate talent and suppliers. Buyers should treat Beijing as a discovery and benchmarking hub, then source through ecosystems with proven export experience.

Hangzhou

A deep bench in legged locomotion and components, home to Unitree and DEEP Robotics within a few hours’ logistics. Hangzhou’s research lineage from Zhejiang University translates to mechatronics talent and actuator startups, and a growing embodied AI innovation cluster.

Shenzhen

Supply chain speed, contract manufacturing at scale, and embodied AI startups like EngineAI that iterate fast on hardware. Also crucial for sensors, batteries, enclosures, and ODM relationships that convert prototypes into shippable SKUs.

6) How to think like DJI, then source like DJI

1) Design for price points you do not yet believe

Start by writing down the embodied AI unit economics that would unlock your buyer, for example sub-US$10k for a developer humanoid, sub-US$40k for a production pilot unit with a basic grasp-and-go repertoire, or sub-US$80k for a line-side assistant that reliably does three repetitive tasks per shift. Then reverse-engineer the bill of materials and joint module decisions that make those price targets credible. Unitree’s R1 price is not a one-off stunt, it is the opening bid for affordable embodied AI adoption.

2) Treat software as a supply chain

You are not buying only hardware, you are buying a pathway to data, model updates, and teleoperation safety nets. Ask for the vendor’s failure dataset policy, on-device inference roadmap, and preventive maintenance instrumentation.

3) Buy reliability the unglamorous way

The Beijing games showed that basic chores are the hardest. Insist on on-site trials around ramps, thresholds, slippery floors, and mixed lighting. Measure mean interventions per hour and recovery time. Make service level agreements about spare joint modules and “time to remote assist” explicit, this is where embodied AI sourcing succeeds or fails.

4) Stage your adoption in three tracks

- Track A, industrial arms first. Use Estun, Efort, Siasun arms to stabilize throughput. Experiment with AI perception and adaptive gripping to upgrade existing cells.

- Track B, legged inspection and logistics. Where terrain is uneven or hazardous, DEEP’s Lynx and Jueying series are built for power plants, tunnels, and emergency paths. They pay back in avoided downtime and safety incidents.

- Track C, humanoid pilots. Use Unitree R1 or EngineAI SA01/SE01 for low-stakes tasks with human oversight, collect data, and design workflows that improve every week.

5) Source to de-risk export

- Verify Regulatory and HS codes early. Humanoids combine multiple subsystems, and customs classification varies.

- Prefer suppliers with CE, FCC, CB histories in other products, not just a promise to certify.

- Build a service kit into your first purchase order: spare actuators, finger modules, cameras, belts, battery packs, harnesses.

7) Risks, straight up

- Over-promising on autonomy. The best videos are not the median shift. Calibrate expectations with task-specific pilots rather than “general purpose” language. The difference between a great 30-second clip and a reliable 8-hour shift is data, lots of it.

- Component bottlenecks. High-torque, low-backlash joints and reducers are still the gating factor for dexterous manipulation. This is where delays and grey-market temptations appear.

- Export controls and supply separation. Dual-use concerns, AI accelerators, and advanced sensors can trigger compliance issues. Choose vendors with clean, documented supply chains.

- Service debt. The GLP, hotel, or factory that trials ten units and has two technicians trained will outperform the competitor that buys twenty units and waits for vendor support.

8) Company spotlights

Unitree, from labs to line items

- What to buy: R1 for developers and demo workflows, G1 where dexterous hands or manipulation research are required, H1 for locomotion research.

- Why it matters: Unitree is one of the first to make embodied AI experiments cheap and repeatable, the critical lever DJI used in drones. The new Hangzhou plant suggests intent to fill orders at volume, and recent media shows national-level visibility, which helps with recruiting and capital access.

- Procurement tip: Lock a price-protected spare parts bundle and request the company’s software update cadence in writing.

- Proof point: Official R1 list price US$5,900.

DEEP Robotics, terrain to humanoid

- What to buy: Jueying X-series for harsh-environment inspection, Lynx for wheel-leg speed and range, DR01 for humanoid R&D.

- Why it matters: DEEP’s IP is failure in the wild, not lab gymnastic tricks. That pays back in inspection, power, and emergency response. The DR01 debut shows the same control stack applied to bipedal agents.

- Procurement tip: Bundle hot-swap batteries and specify testing on the exact floor finishes and grades you operate.

EngineAI, the fast mover

- What to buy: SA01 for education labs, SE01 for pilot projects where lifelike gait matters for safety and acceptance, PM01 as a mid-size option.

- Why it matters: EngineAI compresses the distance between viral embodied AI demos and shippable units, with pricing signals in RMB that are multiples cheaper than Western peers. Early coverage and analyst notes point to fast production aims. Validate carefully, then leverage the price differential.

- Procurement tip: Ask for fall-recovery evidence and warranty language that covers joint replacements and calibration.

9) Outlook to 2030

- Reliability first, generality later. Expect role-specific humanoids to succeed faster than general purpose. Warehouse kitting, retail concierge, and basic line-side assistance will be earlier wins. Service robots continue to subsidize embodied AI development.

- China’s flywheel. Policy guidance, dense supplier clusters, and local deployment speed create a loop that is hard to match. Even if Western firms lead in core model research, the learning-by-doing advantage in Asia drives down cost and raises reliability.

- Capital follows credibility. With large OEMs and municipal programs buying pilots, component makers scale. That lowers unit costs, which increases pilots, which attracts more capital. By 2030 you should expect multiple Chinese vendors offering credible, sub-US$20k pilot humanoids for limited tasks, with service contracts that feel like today’s cobot leases.

10) What buyers should do this quarter

- Pick one workflow you hate. Reception, guided tours, sample delivery, or overnight inventory scans.

- Run a vendor bake-off with one Unitree, one EngineAI, and one DEEP unit where relevant.

- Instrument the pilot. Log interventions, recovery time, false positives, and operator comments.

- Write the scale-plan now. If the pilot meets a threshold, line up the first 10 units with spare joints and batteries.

- Lock your options. Fix a 12-month price for 2x volume with performance gates.

11) What makes this the “DJI moment”

The DJI moment for embodied AI is not a single product, it is a pattern: credible performance at a price that invites experimentation, backed by a manufacturing engine that can actually deliver. Embodied AI is hitting that pattern. The evidence is in hard data on installations and density, in government guidance that prioritizes components and standards, in companies that open factories rather than only posting demos, and in arenas where 500 robots can fail publicly because there are 5,000 getting ready privately.

12) Our edge, your advantage

We maintain a private sourcing list of 200+ vetted robotics suppliers in China, contact us to access it.

It includes shortlists for actuators and reducers, joint module vendors, safety sensors, battery packs, industrial arms and cells, plus humanoid suppliers with export experience. For each, we track:

- Export track record, certifications, component interchangeability

- Lead times, MOQ and NRE policies

- On-site service coverage in your target country

- Firmware update cadence, failure modes, and support SLAs

If you know the task you need done, we will show you the three fastest paths to put a robot on it, with pricing that lets you move now rather than “someday.”

Final note on tone and truth

Plenty of writing about embodied AI either hand-waves with futurism or nitpicks every stumble. The truth sits in the middle. China’s embodied AI push is compressing costs and timelines the same way DJI did for drones. Reliability still must rise, but price, policy, and production are forming a flywheel. That is why now is the moment to source boldly but implement pragmatically, to capture the upside while others wait for perfection.

Sources, selected

- International Federation of Robotics: China’s share of global installations, global robot density. IFR International Federation of Robotics+2IFR International Federation of Robotics+2

- Policy: MIIT Guiding Opinions on Humanoid Robots and municipal action plans. USCCChina Briefing

- Events and reality checks: AP and Reuters coverage of the World Humanoid Robot Games. AP NewsReuters

- Unitree: R1 pricing and factory expansion, plus public product docs. UnitreeSouth China Morning Post+1

- EngineAI: SCMP and Digitimes reporting on product line and reception by Nvidia scientists. South China Morning PostDIGITIMES Asia

- DEEP Robotics: Company materials on DR01 and Lynx, independent coverage of WRC debut. deeprobotics.cn+1Robotics 247

- Market sizing: McKinsey embodied AI outlook and Morgan Stanley humanoid value-chain mapping. McKinsey & CompanyMorgan Stanley

- Industrial arms: Estun, Efort, Siasun capabilities and product ranges. en.estun.com+1SIASUN

Related Articles

Part 1: Embodied AI’s DJI Moment: 5 Proven Steps to Source

Part 2: 5 High-Margin Robotics Categories to Source from China in 2025

Part 3: The Hidden Value Chain of Embodied AI: From Actuators to End‑Use

Part 4: How to De-Risk Robotics Sourcing: Export, Compliance, and Service Gaps

Leave a Reply