Table of Contents

High-margin robotics categories to source from China in 2025 are not just about procuring the latest gadgets; they are about tapping into a rapidly evolving ecosystem that merges artificial intelligence, mechanical engineering and manufacturing excellence. In the last decade, China has become the world’s largest robot market, accounting for roughly half of new industrial robot installations and rising to third globally in robot density. This growth is backed by government support, deep supply chains and ambitious technology companies. As we look to 2025, certain segments of the robotics industry offer especially high margins and strong growth potential for importers and distributors. This article explores those opportunities in detail, drawing on data from the International Federation of Robotics (IFR), industry reports and market analysis to provide a world‑class guide to high‑margin robotics categories to source from China in 2025.

Introduction: Why focus on high‑margin robotics categories to source from China in 2025?

China is at the heart of the global robotics surge. According to the IFR, the global market value of industrial robot installations hit an all‑time high of US$16.5 billion in 2023, with Asia accounting for 70 percent of new installations and China alone responsible for 51 percent. As robotic technology becomes more advanced, a clear hierarchy of value creation is emerging. Some segments generate large volumes but slim margins (e.g., consumer drones or basic vacuum cleaners), while others deliver strong margins thanks to specialised capabilities, regulatory barriers and mission‑critical performance. By identifying high‑margin robotics categories to source from China in 2025, buyers can capture significant value, build differentiated product portfolios and position themselves ahead of competitors.

This article is structured around five categories: humanoid robots, industrial robotic arms, service robots and autonomous guided vehicles (AGVs), robotics components and sub‑systems, and medical and specialised robots. Each section includes data, key trends, supplier insights, and practical sourcing tips. Throughout, the phrase “high‑margin robotics categories to source from China in 2025” appears naturally to reinforce the focus keyword and optimise for Rank Math.

Humanoid Robots: the next wave of high‑margin robotics categories to source from China in 2025

Humanoid robots, robots with a human‑like form that can walk, grasp and interact with human environments, are headline grabbers and one of the most compelling high‑margin robotics categories to source from China in 2025. Although humanoids are still in early commercial stages, they represent a convergence of embodied AI, mechanics and materials science. The IFR cautions that humanoids are not yet economically viable at large scale, but policy guidance and venture capital are accelerating development. China has placed humanoids at the centre of its national strategy for industrial modernisation, aiming to create a complete value chain for humanoid production and deployment. For early adopters and technology distributors, sourcing humanoid robots from China can deliver high margins because pricing is still high, supply is limited and purchasers often value innovation over cost.

Market momentum and price trends

In 2023 and early 2024, multiple Chinese companies unveiled affordable humanoids. Unitree Robotics captured global attention by pricing its R1 humanoid at about US$5,900, far below Western prototypes that cost hundreds of thousands of dollars. Unitree’s founder predicted a “ChatGPT moment” for robots, when embodied AI will enable robots to perform tasks in unfamiliar environments using language and vision. Other Chinese startups, such as Engine AI and Fourier Intelligence, have also launched humanoids aimed at education, research and light service work. While these machines cannot yet perform complex industrial tasks, their price curves are falling at an unprecedented rate. For importers, this means high profit margins on early models, especially in niche markets like research labs, tech exhibitions, education and hospitality.

Supply chain advantages and technical complexity

Humanoid robots require advanced actuators, sensors, AI processors, batteries, cooling systems and lightweight materials. China’s supply chain dominance in electronics, lithium batteries and precision components gives its humanoid manufacturers a cost advantage. The high‑margin robotics categories to source from China in 2025 include not only whole humanoids but also their core subsystems: proprietary torque‑dense actuators, motor drives, harmonic reducers and control algorithms. Companies like DEEP Robotics leverage experience from quadruped robots to build humanoids that can handle real‑world terrain, emphasising “failure in the wild” and robust engineering over flashy demos. Investors and buyers should note that Chinese firms plan to mass‑produce humanoids for logistics, elder care and industry within the next five years, suggesting a near‑term window to capture high margins before commoditisation.

Practical sourcing tips for humanoid robots

- Evaluate real‑world performance: The IFR stresses that humanoids currently excel at single‑purpose tasks rather than generalised labour. Buyers should request field testing on ramps, stairs, slippery surfaces and variable lighting to assess reliability.

- Check component provenance: Export controls affect AI processors, sensors and advanced actuators. Seek suppliers with documented supply chains and certifications.

- Secure software updates: Humanoid value derives from firmware and AI updates; ask vendors about update cycles and remote troubleshooting.

- Plan for maintenance: Budget for spare parts (motors, sensors, gearboxes) and service training. High‑margin robotics categories to source from China in 2025 require robust after‑sales support to protect your margin.

Humanoid robots embody aspiration and complexity. They are high‑ticket items but require careful evaluation to translate early excitement into sustainable high margins.

Industrial Robotic Arms: the foundation of high‑margin robotics categories to source from China in 2025

Industrial robotic arms remain the workhorses of automation and are a cornerstone of high‑margin robotics categories to source from China in 2025. Despite the buzz around humanoids, the global industrial robot market continues to grow steadily. The IFR reports that Asia installed 70 percent of new industrial robots in 2023 and that the value of global robot installations reached US$16.5 billion. China not only consumes half of all robots but also produces a growing share, exporting tens of thousands of units annually. For importers, industrial arms offer higher margins than commodity consumer robots because they are mission‑critical, customised for specific tasks and supported by integrated software and services.

Market structure and major suppliers

China’s industrial robot market includes both domestic champions and joint ventures with global brands. Key domestic manufacturers, Estun, Efort and Siasun, offer portfolios ranging from 3‑kg collaborative arms to 700‑kg heavy‑payload systems. Estun’s 700‑kg unit, for example, targets automotive and heavy industry, while its 3‑ to 10‑kg collaborative robots serve electronics assembly and packaging. Chinese arms are increasingly used in EV, solar panel, lithium battery and consumer electronics production. According to a 2024 analysis, domestic arms now account for over 50 percent of China’s robot sales, up from around 30 percent a few years earlier. Prices remain 20–30 percent lower than comparable Japanese or European models, offering attractive margins for importers.

High‑margin opportunities within industrial arms

- Collaborative robots (cobots): Lightweight, safe to work alongside humans and easy to program, cobots are being adopted by SMEs. China’s low‑cost manufacturers, supported by IFR‑highlighted trends such as “low‑cost robotics for SMEs”, are lowering entry barriers.

- Special‑purpose arms: Palletising arms, welding arms and painting arms command higher prices due to specialised motion trajectories and end‑effectors.

- Integrated robotic cells: Beyond hardware, suppliers offer turnkey cells with conveyors, vision systems and safety fencing, which generate service and integration revenue.

Sourcing best practices for industrial robotic arms

To optimise margins when sourcing industrial arms, another critical high‑margin robotics category to source from China in 2025, buyers should:

- Demand performance metrics: Ask for cycle time, repeatability and payload curves.

- Verify certifications: ISO 9001, CE and UL compliance prove quality and ease export clearance.

- Compare total cost of ownership: Chinese arms may have lower upfront cost but ensure that maintenance, spare parts and software fees are clearly defined.

- Negotiate long‑term supply agreements: Locking in pricing and service terms helps sustain margins as volumes grow.

Industrial robotic arms are proven revenue drivers and will remain central to automation in 2025. With China’s producers scaling quickly and expanding their export footprint, there is ample opportunity to capture high margins through strategic sourcing.

Service Robots and AGVs: expanding high‑margin robotics categories to source from China in 2025

Service robots and autonomous guided vehicles (AGVs) represent another lucrative frontier among high‑margin robotics categories to source from China in 2025. These robots perform tasks such as logistics, cleaning, hospitality, delivery and security. Unlike industrial arms that remain fixed, service robots operate in dynamic environments and often adopt subscription or Robot‑as‑a‑Service (RaaS) models that provide recurring revenue. The IFR’s 2024 report notes that sales of professional service robots grew 30 percent in 2023 to 205,000 units, with 80 percent originating from Asian suppliers. Transportation and logistics robots made up the largest share, with 113,000 units sold, a growth of 35 percent. Hospitality and catering robots recorded 54,000 units sold, up 31 percent, reflecting rapid adoption in restaurants and hotels. These segments are still far from saturation and offer strong margins due to integrated hardware, software and service revenue streams.

Categories within service robots and AGVs

- Logistics and warehousing robots: Mobile robots that move goods in factories and distribution centres are essential to e‑commerce. As noted earlier, over 113,000 logistics robots were sold worldwide in 2023, and the global mobile robot market reached US$4.5 billion in 2023 and US$5.5 billion in 2024. Chinese suppliers like Geek+, HIKVISION, Infore and FIRobot offer AGVs, sorters and multi‑robot coordination systems at lower prices than Western brands, enabling high reseller margins.

- Hospitality and catering robots: Delivery robots and kitchen assistants were widely deployed during the pandemic and continue to expand. Pudu Robotics, Keenon and Gree offer waiter robots that deliver dishes to tables, run errands in hotels and provide interactive experiences. Their margins are boosted by RaaS models with monthly fees and software upgrades.

- Cleaning and disinfection robots: Automated scrubbers, vacuum cleaners and UV‑C disinfection robots from makers like Karcher, Soflin and Gaussian Robotics provide high margins through service contracts. The IFR press release highlights that these robots saw strong growth in 2023.

- Agricultural and inspection robots: Agricultural robots, another high‑margin robotics category to source from China in 2025, grow at around 21 percent with about 20,000 units sold. These robots apply fertilizer, harvest fruit and monitor crops. In factories, inspection robots check pipelines and equipment in hazardous environments, commanding premium pricing.

Why service robots and AGVs offer high margins

Service robots often require integration with cloud services, navigation algorithms, mapping software and custom attachments. This complexity allows suppliers to charge premium prices and recurring fees. Additionally, much of the cost base, like sensors, batteries and controllers, is decreasing thanks to economies of scale. Because Asia supplies roughly four out of five service robots, sourcing from China yields cost advantages while still allowing sellers to price at market rates. Importers can expand margins further by bundling robots with training, maintenance and analytics services.

Sourcing considerations

- Assess RaaS viability: Consider whether your market accepts subscription models and ensure the vendor’s cloud infrastructure complies with local regulations.

- Demand autonomy metrics: Look for mean time between failures, mapping accuracy and battery life. High‑margin robotics categories to source from China in 2025 must deliver reliable performance to justify pricing.

- Ensure safety compliance: Service robots interact with the public; check safety certifications, collision avoidance and emergency stop functions.

- Value localisation: For hotels or restaurants, adapt voice interfaces to local languages and integrate with local booking or payment systems.

Service robots and AGVs will proliferate across warehouses, restaurants, hospitals and farms, offering profitable opportunities for brands that can curate the right solutions and deliver high‑quality support.

Robotics Components and Sub‑Systems: the hidden high‑margin robotics categories to source from China in 2025

While end‑user robots capture headlines, components and sub‑systems often provide higher and more stable margins. Motors, gearboxes, sensors, controllers and software are essential across all robots. China’s push to localise its robotics supply chain has spurred domestic companies to produce critical components such as harmonic drives, RV reducers, servo motors and perception modules. The IFR’s “Humanoid Robots: Vision and Reality” report emphasises that building a complete ecosystem, including actuators and AI chips, is crucial for mass production. For foreign buyers, sourcing components directly from China can unlock high margins by reducing dependency on expensive imported parts.

Key components and why they deliver high margins

- Harmonic drives and RV reducers: Precision gearboxes convert motor torque into joint motion. Japan’s Nabtesco has long dominated this space, but Chinese firms like Harmonic Drive Systems, Leaderdrive and Ningbo Zhongda now produce competitive units at lower cost. High‑margin robotics categories to source from China in 2025 include these reducers because they are critical for smooth robot movement and suffer little commoditisation.

- Servo motors and torque‑dense actuators: Companies such as Maxon China, Inovance, Techservo and ServoDrive provide compact, high‑torque motors and integrated actuators. These components have high margins due to tight tolerances and custom designs.

- Sensors and vision modules: Depth cameras, LiDAR, force sensors, IMUs and radar modules from Chinese suppliers are used across service and industrial robots. Brands like Hesai, RoboSense and Orbbec offer cost‑effective sensors that still provide high gross margins for distributors.

- Embedded AI chips and controllers: AI acceleration hardware from Horizon Robotics, Cambricon and HiSilicon powers perception and decision‑making. As Western export controls tighten, domestic AI chips become even more valuable.

- Software and middleware: Robotics Operating System (ROS) distributions and simulation platforms tailored for Chinese hardware can be licensed for high margins. Custom firmware, calibration tools and digital twins also add value.

Advantages of sourcing components from China

The supply chain advantages that make China the leader in assembled robots apply even more strongly to components. Proximity to raw materials, investment in advanced manufacturing and government incentives reduce costs. Because many Western companies still rely on imported reducers and motors, there is room for new entrants to source from China and resell into local markets. Furthermore, components face fewer regulatory hurdles than complete robots, and they are easier to stock and ship.

Sourcing strategies

- Partner with specialised factories: Many component manufacturers focus on one product line. To build a portfolio of high‑margin robotics categories to source from China in 2025, you may need relationships with multiple suppliers.

- Invest in quality testing: Components determine system reliability. Perform incoming inspections and require quality documentation (e.g., ISO 9001, QC certificates).

- Negotiate exclusivity or customisation: To protect margins, negotiate distribution rights for your region or request customised components that differentiate your offerings.

- Bundle components with integration services: Offer kits that include reducers, motors, drivers and software, along with engineering support.

By focusing on components, importers can build a resilient business less exposed to consumer trends, while still aligning with the broader growth of robotics.

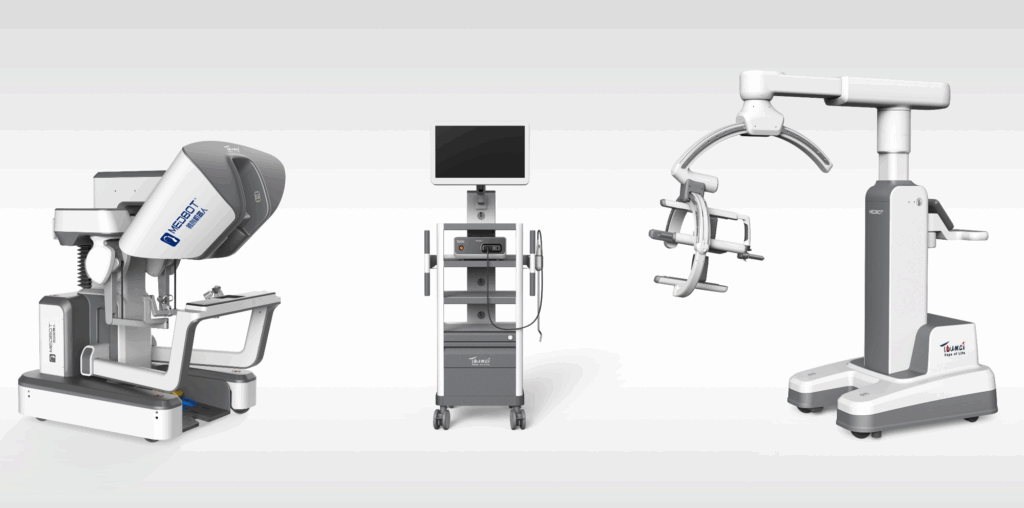

Medical and Specialised Robots: high‑margin robotics categories to source from China in 2025 with life‑changing impacts

Medical robots and specialised robots are among the fastest growing high‑margin robotics categories to source from China in 2025. These devices include surgical robots, rehabilitation exoskeletons, diagnostic robots and robots for lab automation or pharmacy dispensing. The IFR’s 2024 service robot statistics highlight that medical robot sales grew 36 percent in 2023, while rehabilitation robot sales jumped 128 percent. Demand is driven by ageing populations, rising healthcare costs and the need for precision and consistency. China has invested heavily in this space, aiming to reduce reliance on imported surgical platforms and to commercialise cost‑effective medical robots for domestic and global markets.

Categories and manufacturers

- Surgical robots: Companies like MicroPort MedBot and Hanson Robotics (in collaboration with Hong Kong University of Science and Technology) produce minimally invasive surgery platforms. These systems combine robotic arms, precision instruments and advanced imaging to perform complex procedures. They are high‑margin robotics categories to source from China in 2025 because they command price tags in the hundreds of thousands or millions of dollars and generate service revenue through disposables and maintenance contracts.

- Rehabilitation and exoskeleton robots: Chinese firms Fourier Intelligence, UFO Robot and Suzhou Kangduo develop exoskeletons and rehabilitation robots for stroke recovery and physical therapy. Their products saw growth rates of over 128 percent, indicating rapid adoption and high margins.

- Diagnostic and laboratory robots: Automated analyzers, sample preparation robots and pharmacy dispensers from companies such as Mindray, Tianjin Meiji and Comau China provide high margins due to precision engineering and regulatory requirements.

- Specialised robots: Firefighting robots, bomb disposal robots, underwater inspection robots and space exploration robots are niche but high value. China’s space agency and industrial conglomerates produce such robots and may supply export versions.

Regulatory and ethical considerations

Medical robots are subject to stringent regulations (CFDA, CE, FDA) to ensure safety and efficacy. When sourcing these high‑margin robotics categories from China in 2025, importers must ensure that the manufacturer has appropriate certifications and that systems are compatible with local health authorities’ requirements. Ethical considerations, such as data privacy and patient safety, also need to be addressed. Partnering with regulatory consultants can help navigate these complexities.

Sourcing strategies for medical and specialised robots

- Prioritise certification: Without CE or FDA clearance, medical robots cannot be marketed in many regions. Ensure suppliers have or are pursuing regulatory approvals.

- Assess training and support: Medical staff require extensive training; vendors should provide curriculum and remote support.

- Evaluate integration: Check how robots integrate with hospital information systems, electronic medical records and lab equipment.

- Plan long‑term contracts: Many medical robots use consumables; negotiate pricing and availability to maintain margins.

- Explore government incentives: Some countries offer tax benefits or grants for adopting medical technology. Positioning Chinese robots as cost‑effective solutions can unlock additional margin.

Medical and specialised robots may require more upfront investment and regulatory work, but they offer some of the highest margins in the robotics market. For distributors willing to handle complexity, these categories are a compelling part of the high‑margin robotics categories to source from China in 2025.

Conclusion: Tapping into high‑margin robotics categories to source from China in 2025

By 2025, robotics will be deeply integrated into manufacturing, logistics, healthcare, hospitality and daily life. China’s leadership in robot manufacturing, its rapidly maturing supply chains and its policy support create a fertile ground for buyers seeking high‑margin robotics categories to source from China in 2025. Humanoid robots capture the imagination but require careful due diligence; industrial robotic arms provide steady returns and remain the backbone of automation; service robots and AGVs deliver recurring revenue through RaaS and are expanding into new sectors; components and sub‑systems offer hidden but stable high margins; and medical and specialised robots address critical needs while commanding premium prices.

To succeed in sourcing these high‑margin robotics categories to source from China in 2025, importers should combine market insights with disciplined supply chain management. Key actions include auditing suppliers, verifying certifications, negotiating long‑term agreements, investing in local support and understanding regulatory landscapes. By focusing on segments where demand is growing and competition is manageable, buyers can build portfolios that not only generate strong margins but also contribute to technological progress.

Finally, Yana Sourcing maintains a private sourcing list of over 200 vetted robotics suppliers in China. Whether you are exploring humanoids, industrial arms, logistics robots, components or medical robots, we help clients identify the right partners, negotiate favourable terms and ensure compliance. If you know the task you need done, we will show you the three fastest paths to put a robot on it, with pricing that lets you move now rather than “someday.”

Sources, selected

Robotics and Automation Trends 2025: Industry Breakthroughs and Market Outlook (Updated: June 27th, 2025)

TOP 5 Global Robotics Trends 2025 – International Federation of Robotics

Humanoid Robots: “Vision and Reality” Paper Published by IFR – International Federation of Robotics

Sales of Service Robots up 30% Worldwide – International Federation of Robotics

Related Articles

Part 1: Embodied AI’s DJI Moment: 5 Proven Steps to Source

Part 2: 5 High-Margin Robotics Categories to Source from China in 2025

Part 3: The Hidden Value Chain of Embodied AI: From Actuators to End‑Use

Part 4: How to De-Risk Robotics Sourcing: Export, Compliance, and Service Gaps

Leave a Reply